Coin collecting in the 2020s entered unfamiliar territory. Supply chains broke, production schedules shifted, and the U.S. Mint adjusted strategies in real time. The result was a decade that produced unplanned scarcity, visible errors, and tightly capped revivals—all ingredients that push modern issues into collector focus quickly.

Unlike earlier decades, price discovery now happens fast. Grading populations update daily. Auction results spread within hours. 2023 quarters can move from pocket change to four figures before most collectors notice. Understanding why this happens is the first step to identifying which 2020s releases have staying power.

What Makes a 2020s Coin “Promising”

Not every new release qualifies. The strongest candidates share a narrow set of traits that persist beyond initial hype.

Key drivers include:

- Artificial scarcity, created through low mintages or limited finishes

- Accidental rarity, such as die breaks, grease fills, or hub doubling

- Firsts and revivals, especially designs returning after decades

- Condition competition, where MS-70 populations stay tiny

Coins that combine two or more of these factors tend to separate from the pack.

The Shift from Circulation to Instant Collectibles

Earlier eras relied on time to reveal rarity. The 2020s do the opposite. Scarcity appears immediately.

Examples of structural change:

- Privy marks added to circulating coins

- Short-run proofs announced with hard caps

- Pandemic-era production inconsistencies

This environment favors collectors who track releases closely through the coin value checker app rather than those waiting for long-term circulation attrition.

The “W” Mint Mark Effect

One of the most important developments began just before the decade and carried forward: the West Point “W” mint mark entering circulation.

Why it matters:

- West Point traditionally struck bullion, not pocket change

- Circulating “W” coins were capped at low totals

- Collectors recognized scarcity immediately

This set the template for how modern circulation finds can achieve instant premium status.

Early 2020s Standouts Set Expectations

A few releases defined collector psychology early in the decade.

| Issue | What Changed |

| 2019–2020 W Quarters | Proved circulation can still surprise |

| V75 Privy Issues | Combined history with low mintage |

| Pandemic Strikes | Increased error frequency |

Once collectors saw four- and five-figure results for modern coins, expectations shifted. New releases began trading on potential rather than age.

Why Timing Matters More Than Ever

Modern coins reward early attention. Prices often peak when:

- Grading populations are lowest

- Supply is locked in holders

- Demand spreads beyond specialists

Later corrections do happen, but only coins with real scarcity establish new baselines instead of falling back to issue price.

Standout 2020s Issues That Redefined Modern Collecting

Several releases from the 2020s quickly proved that modern coins could carry long-term collector weight. These issues did not rely on age. They relied on measurable scarcity, recognizable features, and documented demand, shown easily through the free coin value app.

2020-W V75 World War II Quarters

The V75 quarters marked a turning point. For the first time, a circulating U.S. coin carried a privy mark—a small “V” celebrating the 75th anniversary of the end of World War II.

Why these quarters matter:

- Only 2 million coins per design

- First circulating U.S. coins with a privy mark

- Historical theme with broad appeal

Most examples circulated briefly before collectors pulled them aside. High-grade survivors became scarce fast. Certified MS-68 examples reached $40,000, driven by tiny population counts. These quarters established that circulation coins could behave like limited issues.

American Women Quarters Errors (2023)

The American Women Quarters Program introduced new designs each year. In 2023, production volume collided with die fatigue, producing some of the most visible modern errors in circulation.

Notable examples include:

- “IN COD WE TRUST” grease-filled dies

- Die cracks and retained breaks, such as the Maria Tallchief “broken arm”

- Repeated error patterns confirmed across multiple finds

Despite mintages exceeding 1.6 billion coins, demand narrowed to a handful of error examples. Clear “In Cod We Trust” pieces from Denver reached $900, while dramatic die cracks sold for hundreds even without certification.

These coins demonstrated a key modern rule: verification rarity outweighs total mintage.

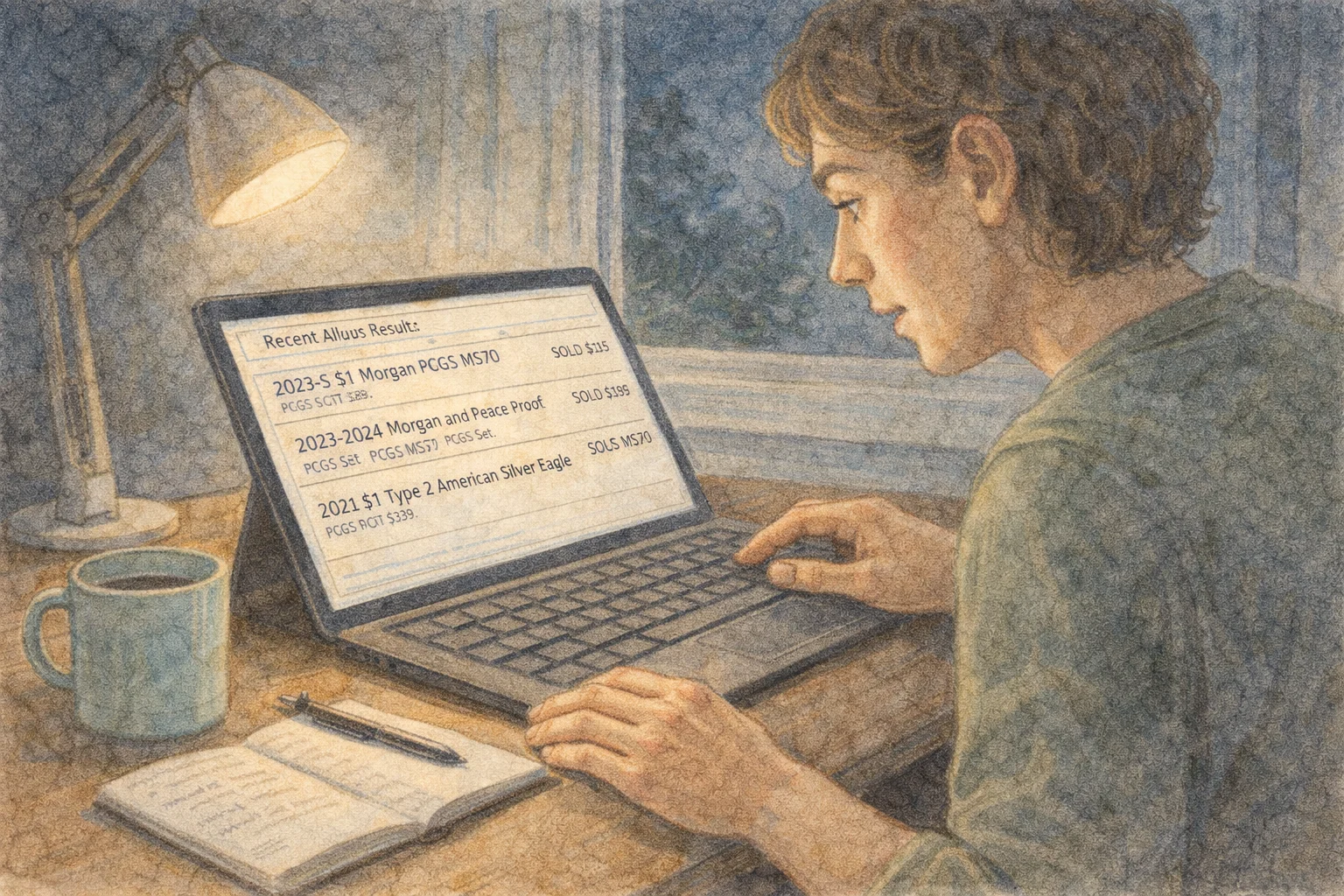

Morgan and Peace Dollar Revivals (2021–2023)

The revival of Morgan and Peace dollars brought classic designs back under modern constraints. Production caps were strict, and silver shortages disrupted schedules, unintentionally creating keys.

Why collectors reacted strongly:

- Fixed mintages, often under 300,000 pieces

- Multiple finishes across different mints

- Interrupted production creating one-year gaps

West Point reverse proofs and Philadelphia uncirculated issues became instant targets. MS-70 examples routinely traded above $500, driven by registry competition and limited availability.

Snapshot of Key 2020s Performers

| Issue | Scarcity Driver | MS-70 Range |

| 2020-W V75 Quarters | Privy + low mintage | Up to $40,000 |

| 2023 Women Quarter Errors | Die varieties | $900+ |

| 2023 Morgan Proofs | Revival limits | $500+ |

| 2019-W ATB Quarters | Circulating “W” | $75,000 |

Each of these issues changed collector expectations. They proved that modern coins could command serious premiums quickly when structure and scarcity align.

Bullion Crossovers, Staying Power, and How Collectors Choose Wisely

Not every hot release from the 2020s will age well. The coins that hold value over time tend to sit at the intersection of scarcity, clarity, and continued demand. Bullion crossovers and disciplined selection play a big role in that outcome.

Silver Eagles: When Bullion Becomes Collectible

The American Silver Eagle series bridged bullion and numismatics during the 2020s. Production pauses, design changes, and finish variations reshaped demand.

What pushed select issues higher:

- Type 2 reverse debut, creating a natural dividing line

- Proof and burnished formats limited by capacity

- Short production windows following silver shortages

Certified MS-70 and PR-70 examples of 2023 issues commonly trade above $150, even without extreme mint caps. The appeal comes from a stable collector base combined with measurable grade scarcity.

Why Some Modern Coins Cool Off

Price pullbacks are normal once initial demand fades. Coins lose momentum when:

- Grading populations expand quickly

- Supply unlocks from hoards or late submissions

- Demand centers on novelty rather than structure

Coins that relied on hype alone often retrace toward issue price. Coins anchored by low mintages, named errors, or registry competition establish new baselines.

Signals That Point to Long-Term Relevance

Collectors looking beyond the first spike watch for consistent indicators.

Strong candidates usually show:

- Stable population reports after the first year

- Repeat auction results at similar levels

- Ongoing inclusion in registry sets or series checklists

If demand persists after excitement fades, value tends to stick.

Practical Ways Collectors Track 2020s Issues

The pace of modern markets makes organization essential. Many collectors photograph new finds and releases, then review specifications—year, mint, composition, diameter, weight, and recent price ranges—using tools like the Coin ID Scanner app. Collection tracking and smart filters help prioritize low-mintage pieces and separate genuine risers from short-term noise.

A Balanced Strategy for the 2020s

Rather than chasing everything, experienced collectors narrow their focus.

A practical approach:

- One circulating scarcity (W mint or privy issue)

- One documented error with clear diagnostics

- One limited revival or proof with capped mintage

This structure limits exposure while keeping upside.

The 2020s reshaped how coins become valuable. Scarcity now appears by design, error visibility spreads instantly, and grading defines competition. Coins that combine these forces rise fast—and the best of them stay relevant.

Collectors who understand these mechanics do not rely on luck. They recognize patterns early and choose releases that still make sense after the first wave passes.